V17 - September 2024 Report

September 2024 Summary

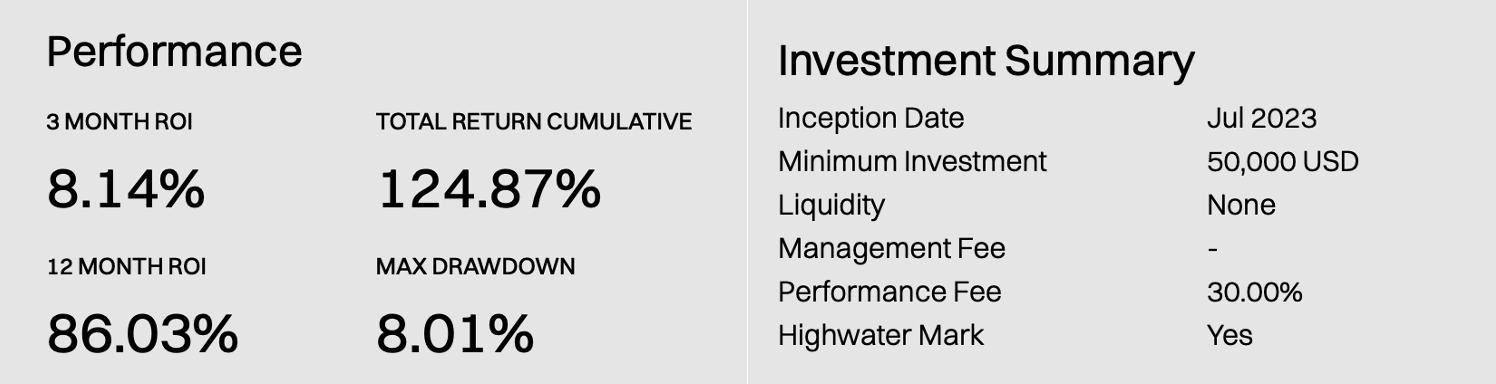

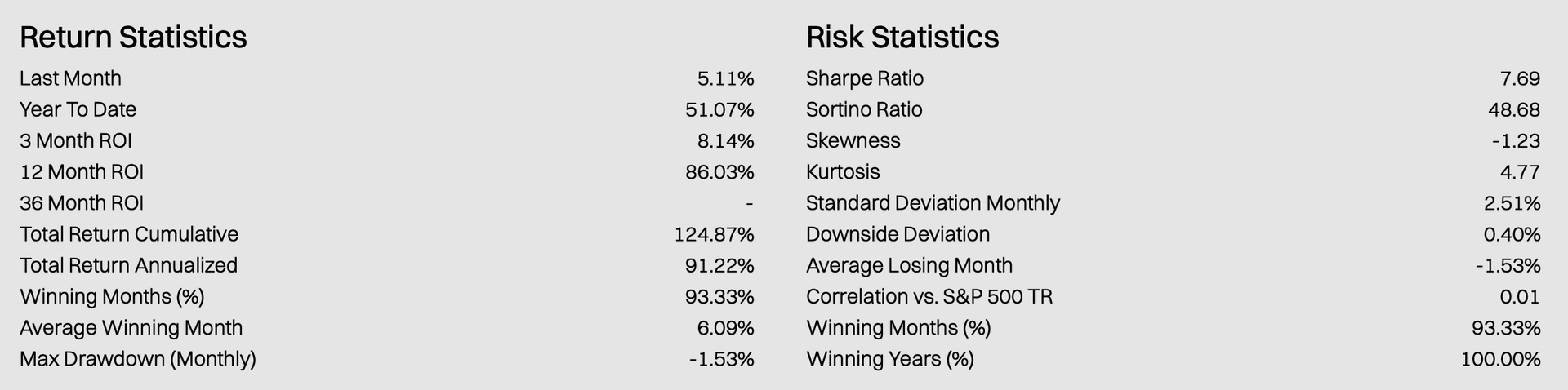

The V17 strategy generated a strong monthly profit of 5.11%. AUDCAD emerged as the most traded pair throughout the month. A total of 904 trades were executed, maintaining a win rate of 72% and achieving a profit factor of 2.20. The highest balance drawdown remained minimal at 0.4%, while the highest equity drawdown reached 3.6%. Trade durations varied with the longest trade lasting 584.61 hours and the shortest just 0.01 hours, with an average trade length of 48.24 hours. Lastly, the strategy captured 3,724.7 net pips during the month.

Strategy Summary

V17 is a state-of-the-art trading system that optimises investment strategies through advanced correlation analysis, utilising genetic algorithms, and ensembled filtering with ML. It is the second of three V-series systems developed, featuring an NSGA-11 genetic algorithm-based allocation module. The system dynamically allocates capital across 17 independent subsystems, trading FX and commodities. It finds optimal allocations based on risk-adjusted return metrics such as Smart Sharpe and Sortino, as well as portfolio variance and advanced correlation data. It uses a proprietary scoring framework to evaluate subsystem performance, further focusing on diversification, and risk stability. The system employs continuous learning, analysing over 300 technical parameters per trade to adapt to evolving market conditions. It holds trades on average for 24 hours and takes 900 positions per month. Its 17 subsystems makes It the medium-sized V-series option with excellent diversification. Allowing access with a minimum deposit of $500.

Strategy Provider

The founding of Vasdan & Co Investments was not an impulsive decision taken quickly: it was the direct fruition of years of industry experience gained in collaboration with a diverse array of fund managements and investment companies. Combined with a strong technological aptitude and established industry network, the formation of Vasdan & Co Investments was a natural decision.

Investment Conditions

Vasdan & Co Investments Ltd (the company) operates business in a fully regulated environment through its partnership with Pelican, who is both authorised and regulated by the Financial Conduct Authority in the UK, ref 534484. Registered address: 85 Great Portland Street, First Floor, London, W1 W7LT. Pelican oversee and monitor the company’s management.

Due to the company’s focus being aimed towards the sophisticated investor, Vasdan & Co Investments Ltd works on an application basis only. If your application is successful, you will have the opportunity to utilise the power of our trading strategies by running your personal brokerage account side by side with our in-house operations.

Clientele of the company maintain in complete control of their brokerage account but utilise the unique investor privilege of their account syncing with our in-house operations. Our clientele’s brokerage accounts will automatically mirror all trades executed into their account with the correct risk allocation through technology managed by our regulated partners, Pelican.

Our unique company structure provides the perfect investment solution for busy professionals looking to build their wealth effortlessly and consistently using a hands-off approach, combined with complete visibility and control of their investments 24/7 through a custom client portal. At no point will Vasdan & Co Investments Ltd have direct access to client funds - client funds remain under their control and in their full custody at all times.

Regulation

For the avoidance of doubt Vasdan & Co Investments Ltd is not independently regulated by the FCA. Vasdan & Co Investments Ltd is a ‘Strategy Provider' to Pelican Trading. Pelican Trading is a trading name of London & Eastern LLP. London & Eastern LLP is authorised and regulated by the Financial Conduct Authority in the UK, ref 534484. Registered address: 85 Great Portland Street, First Floor, London, W1 W7LT.

Disclaimer

Spread betting and CFD trading are leveraged products and as such carry a high level of risk to your capital which can result in losses of your entire deposit. These products may not be suitable for all investors. CFDs are not suitable for pension building and income. Ensure you fully understand all risks involved and seek independent advice if necessary.

If V17 is something that interests you book a call below!